Savings Pathway

A personal, gamified experience that helps individuals establish a rainy day fund

Discovery, Ideation, Design, System Architecture

Serverless, CRM, Payments, Cloud Database, Analytics & More

iOS, Android & responsive web

Modern fintech infrastructure

Overview

Make was asked to concept an innovative experience that encourages individuals to establish and grow a liquid savings fund. A secondary set of product objectives were to teach financial literacy and cultivate community support.

The Problem

According to research, about 40% of Americans can’t afford an unexpected expense over $400 and over 20% have no emergency savings at all. These people are one “life curveball” away from having zero savings and possibly entering debt. This financial stress has often led to anxiety for many people and hindered them from ever achieving their financial goals.

The Solution

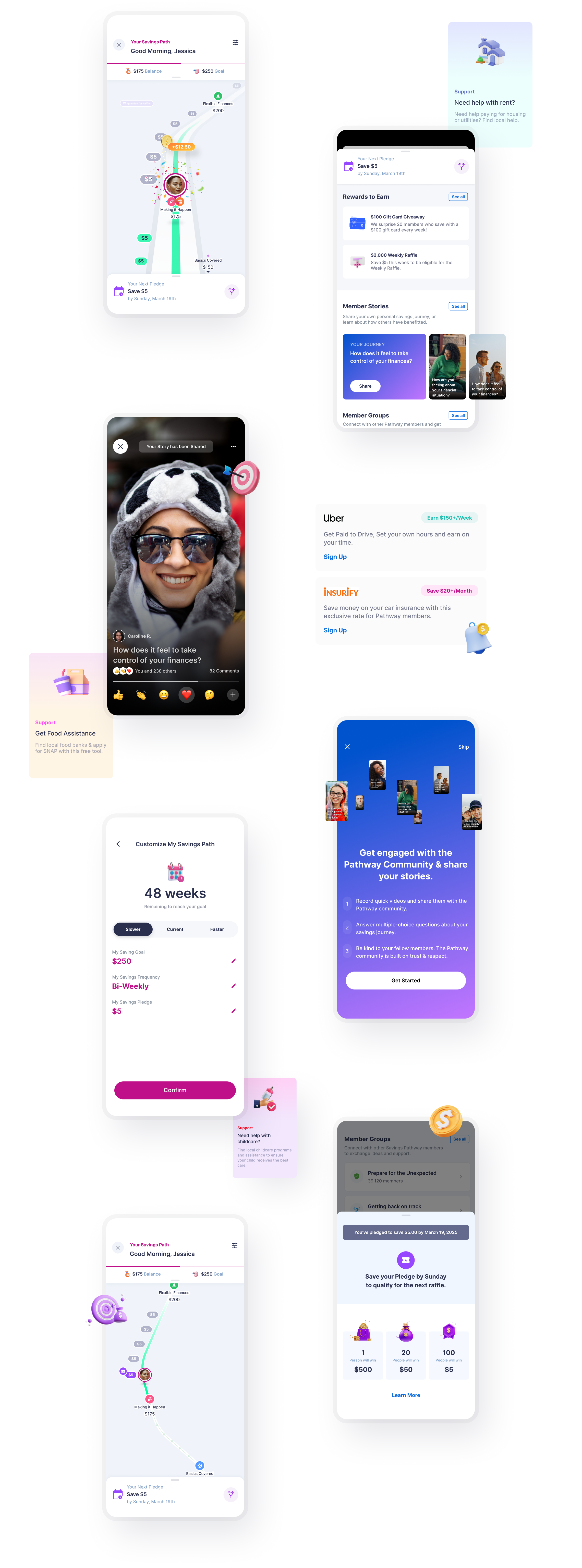

The end result was a distinct, gamified savings experience that encourages people to cultivate a savings habit. Micro-savings pledges are interwoven with weekly raffles and surprise matching bonuses. There are also reddit-like groups to spur community support and interaction throughout the savings journey.

Discovery

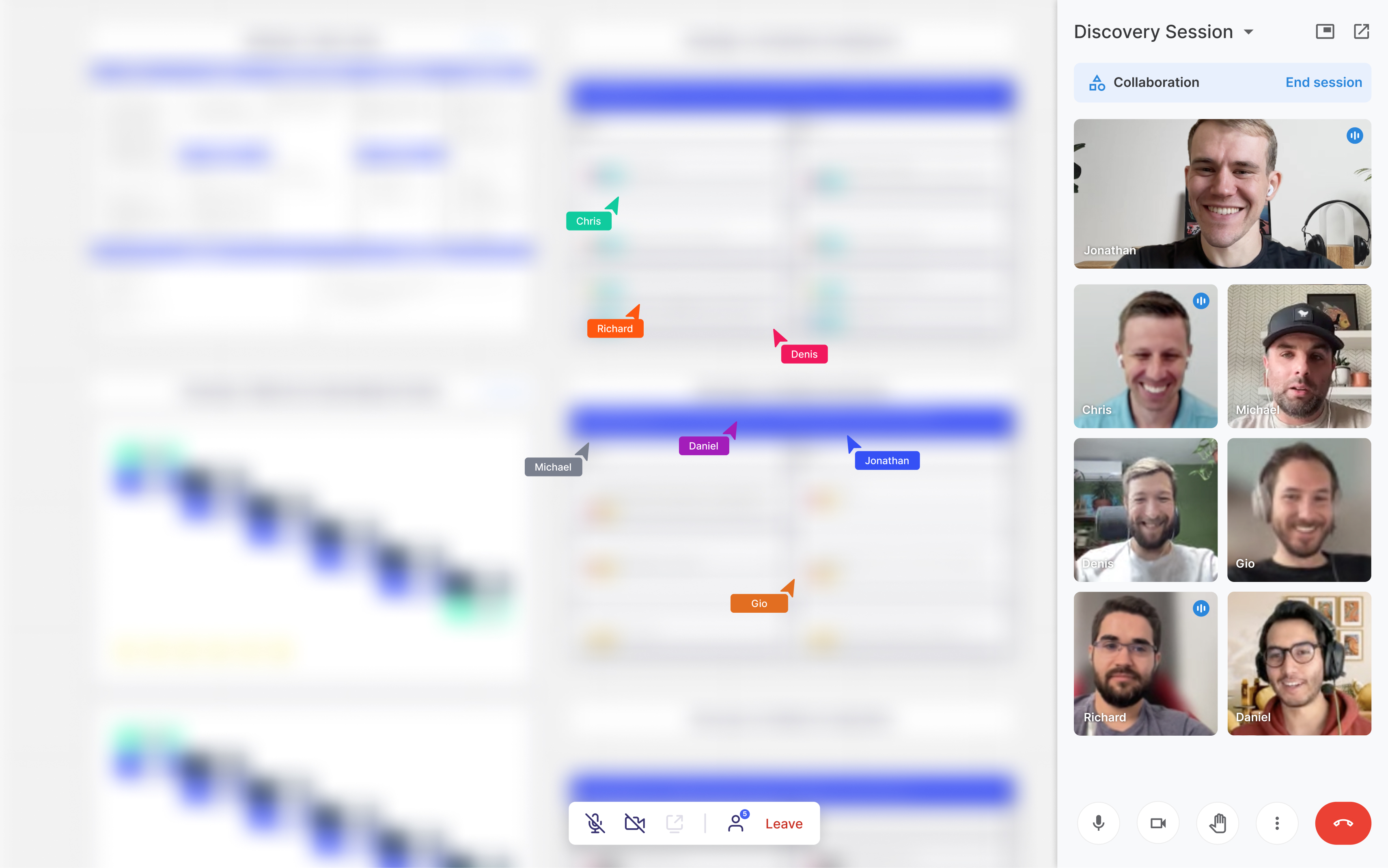

Collaborative working sessions began by uncovering the top 3 problems and understanding ‘the whys’ of each. Brainstorming led to a host of solutions for each problem statement. The top ideas were selected and flushed out. They were then paired with the organization’s unique value proposition and primary objectives. The end result was a product canvas (aka ‘north star’) that articulated a bold vision, innovative product and list of functionality to explore through prototypes.

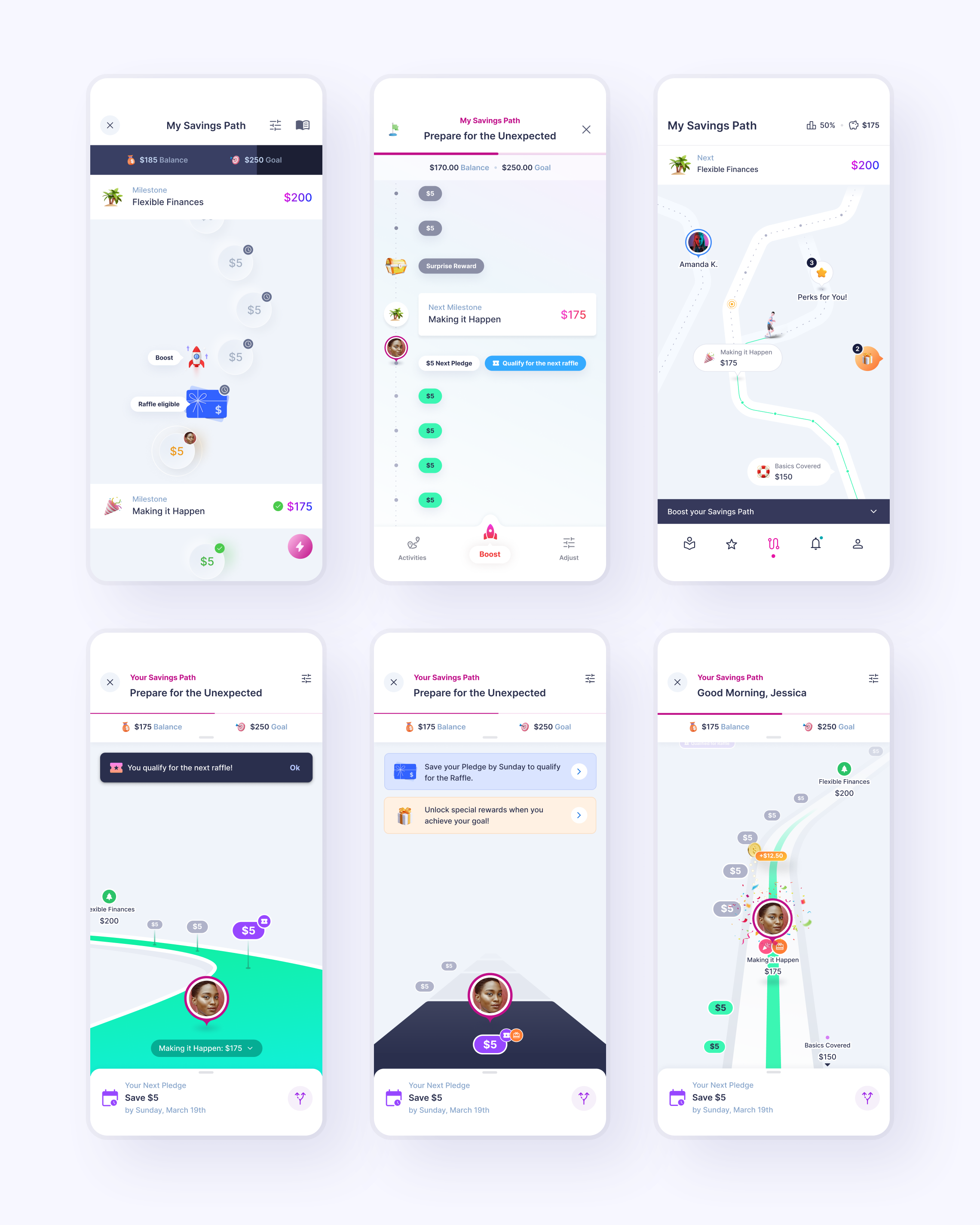

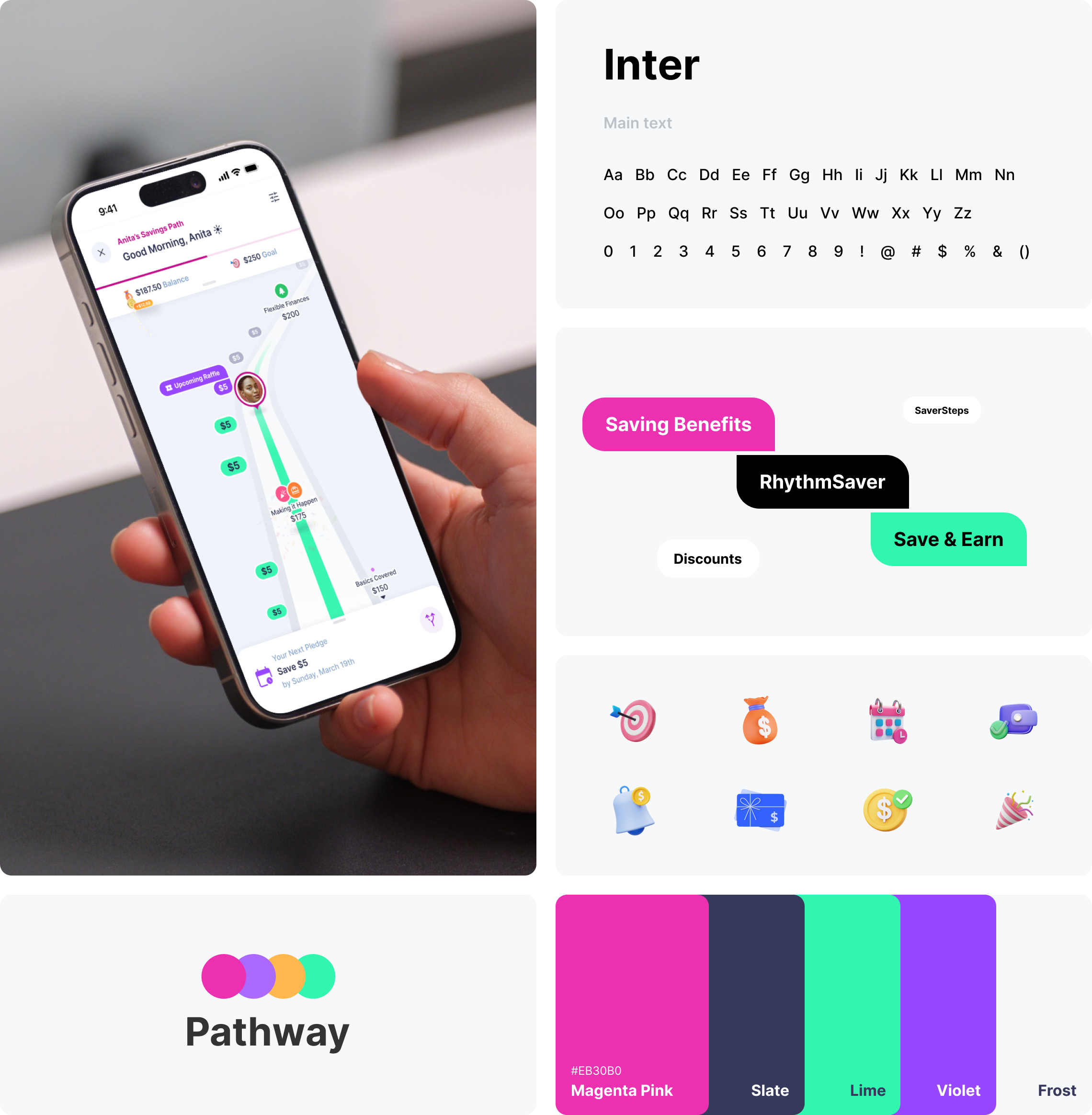

Design

The client wanted to explore a wide range of user experiences that centered on the “pathway” aspect of building a savings account. Each person’s path contained a personalized savings goal that was broken down into micro-milestones to help it feel achievable. Recurring savings targets were layered-on to help users develop consistency towards a savings habit. Community-oriented interactions were also threaded throughout the experience in order to help people learn from others and stay committed.

Architecture

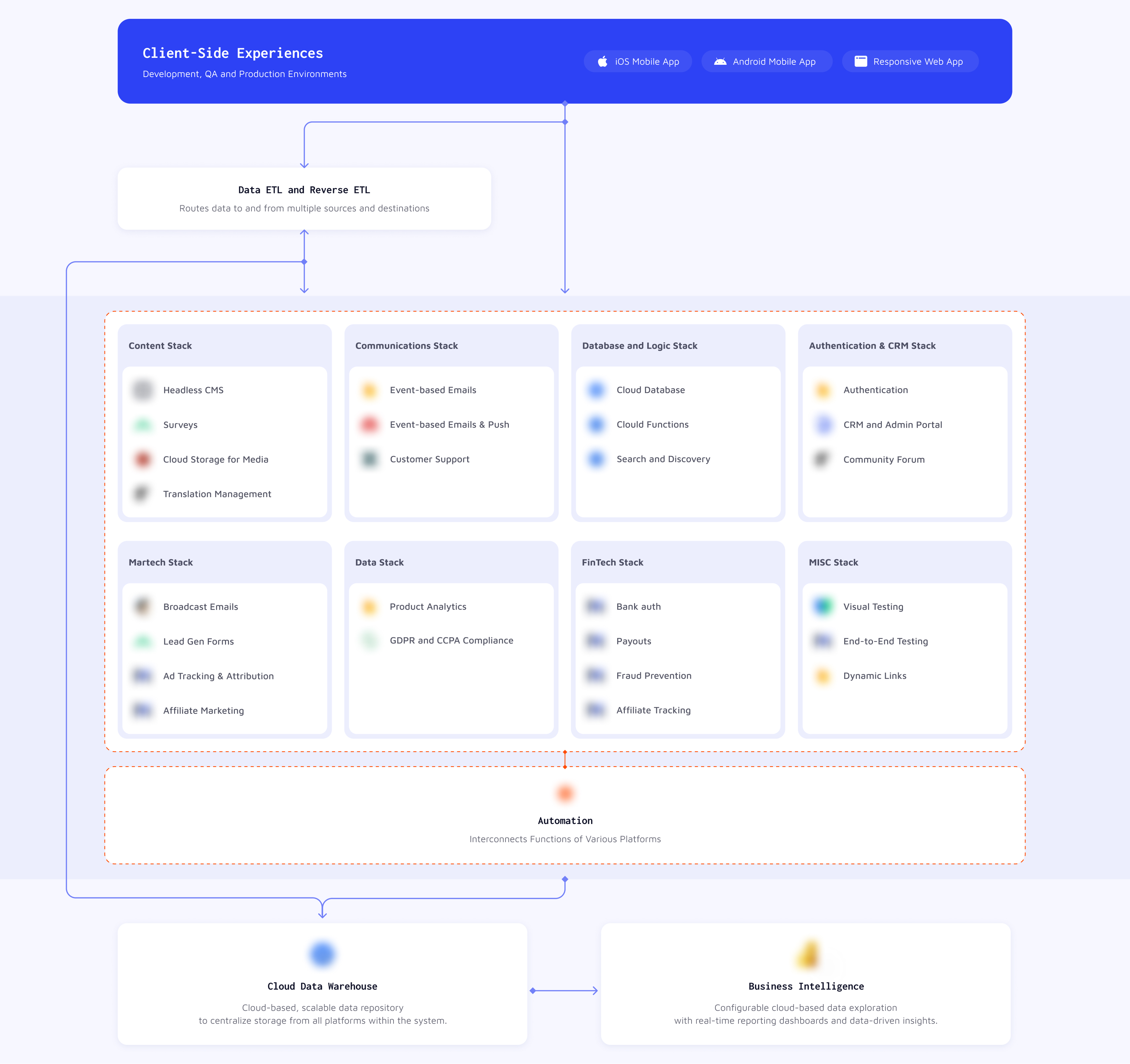

With the defined functionality of the future state, Make performed a gap analysis between it and the capabilities of their current legacy system. The result was a new distributed architecture that preserved some existing platforms, replaced others and added new capabilities into a cohesive system.

Development

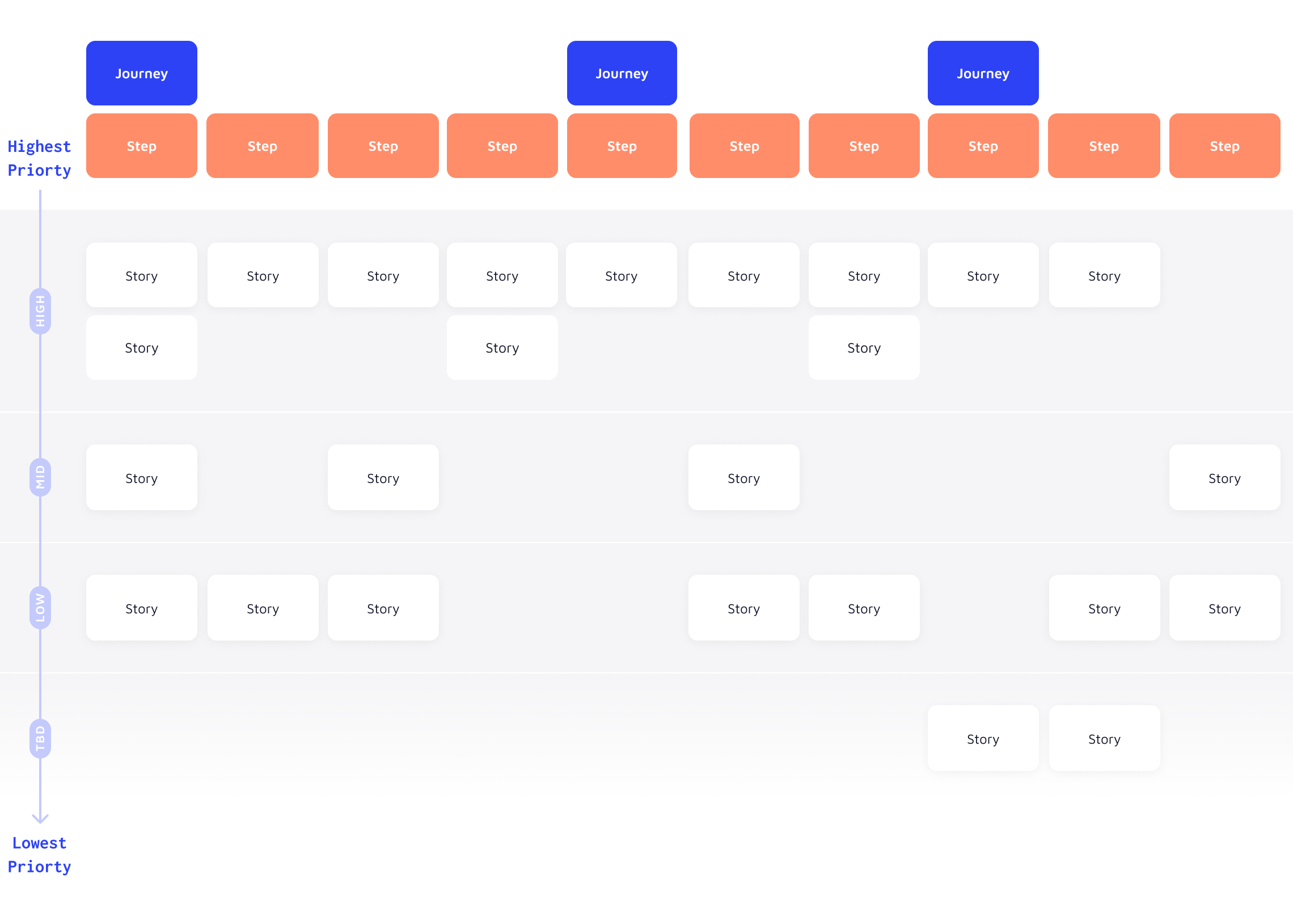

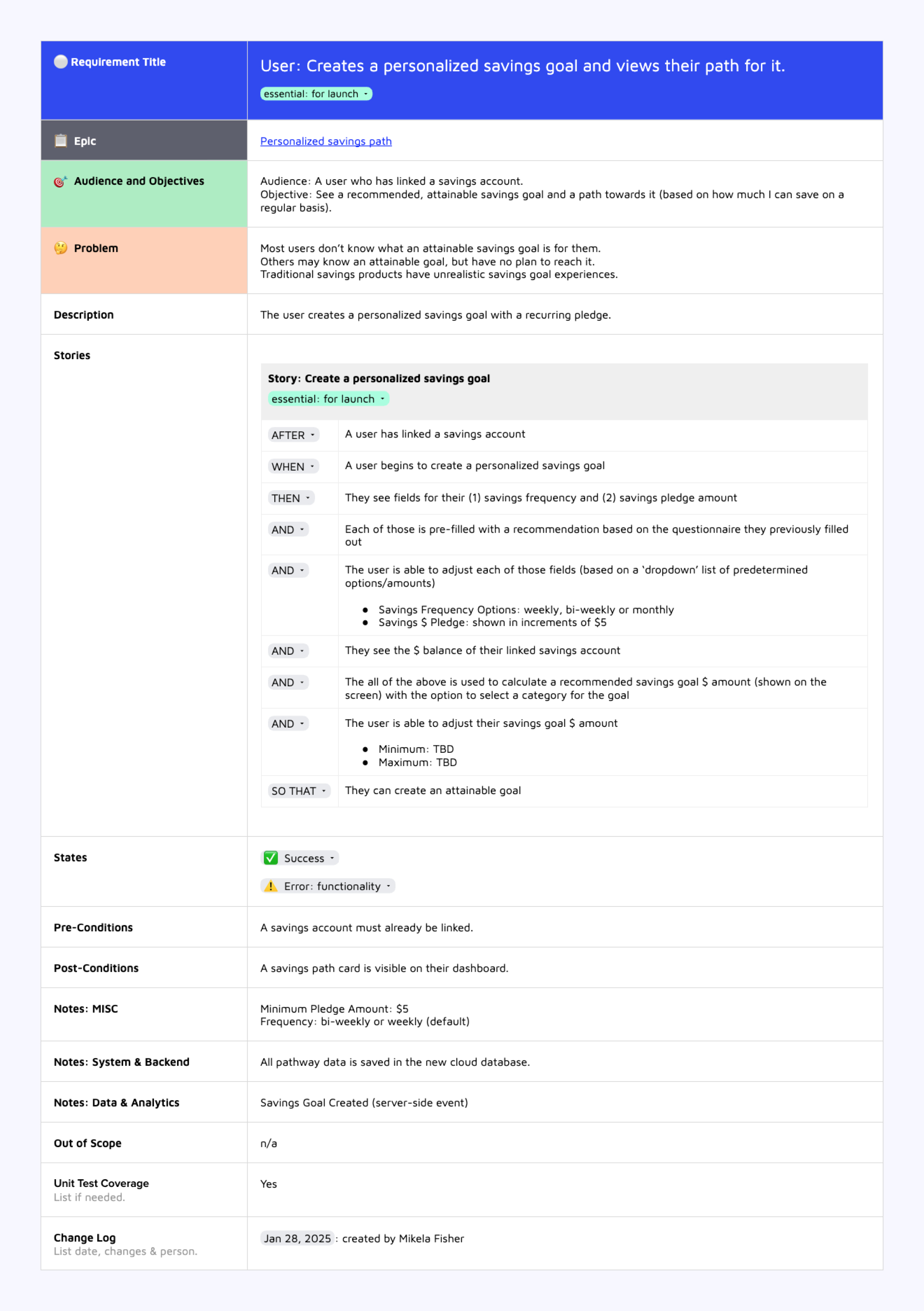

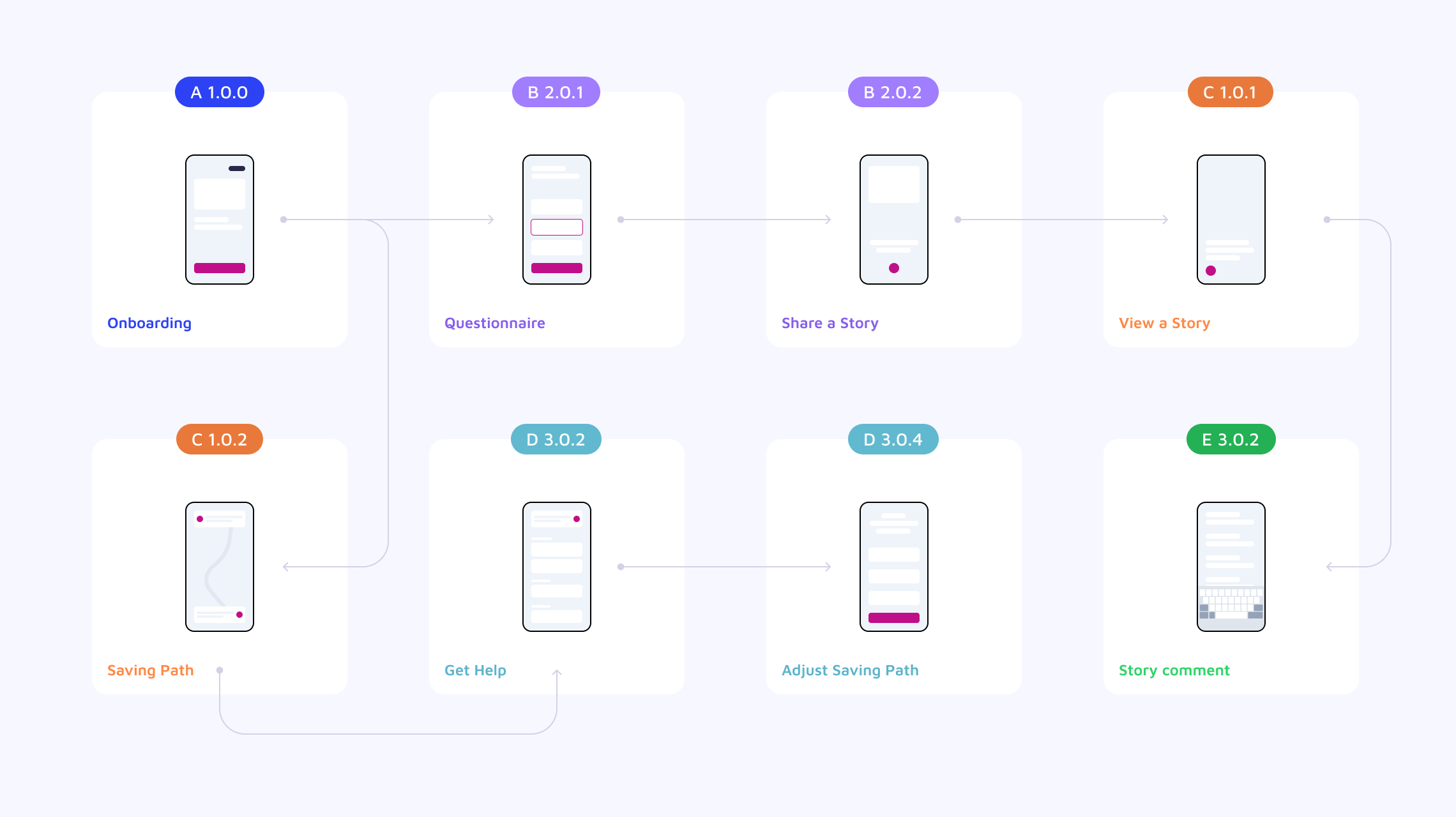

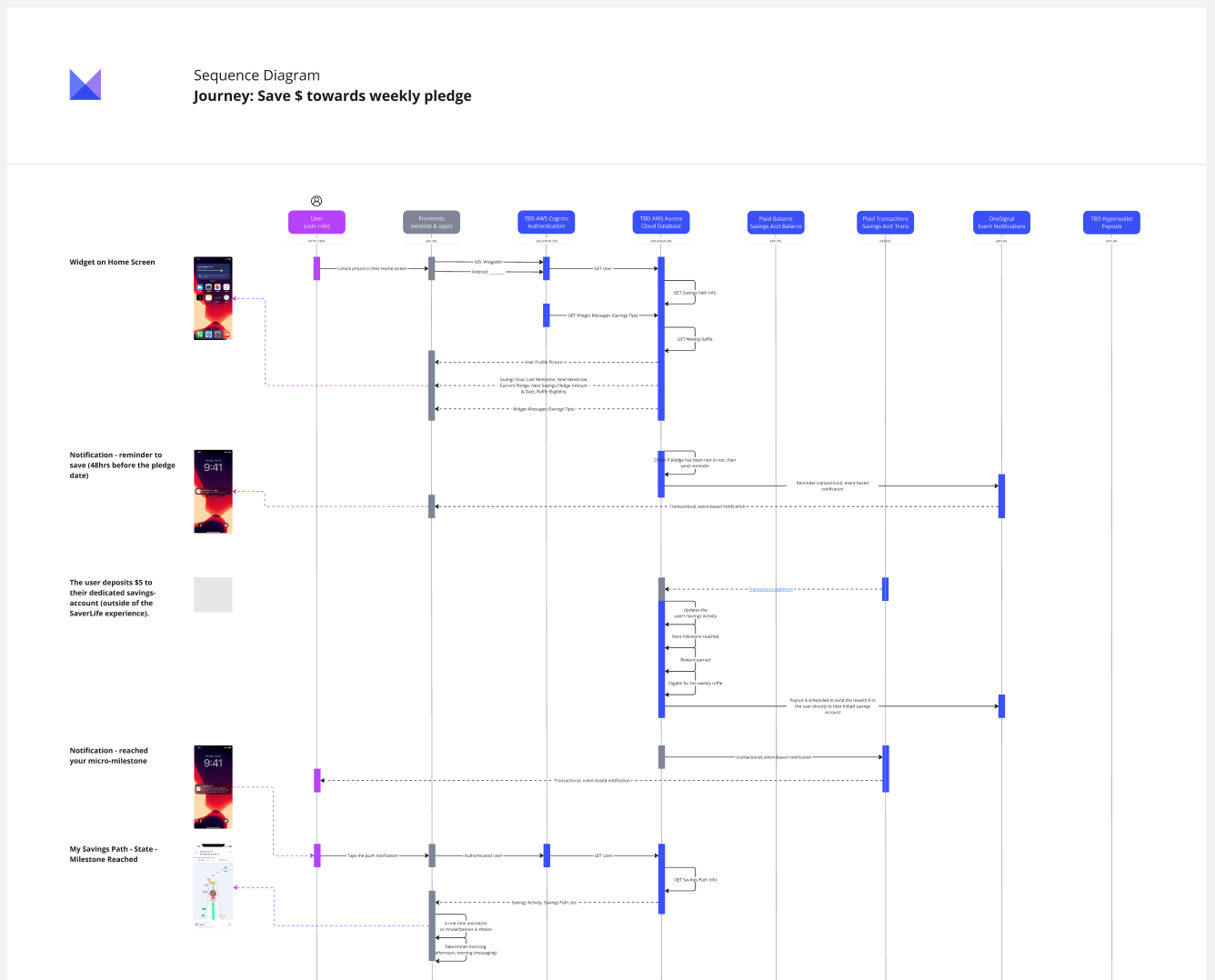

Each of the primary journeys were broken down into sequence diagrams to define how the functionality and data would be implemented in the future system. Paired with the written requirements, these diagrams formed the technical specs for coding the features and integrations.

Data

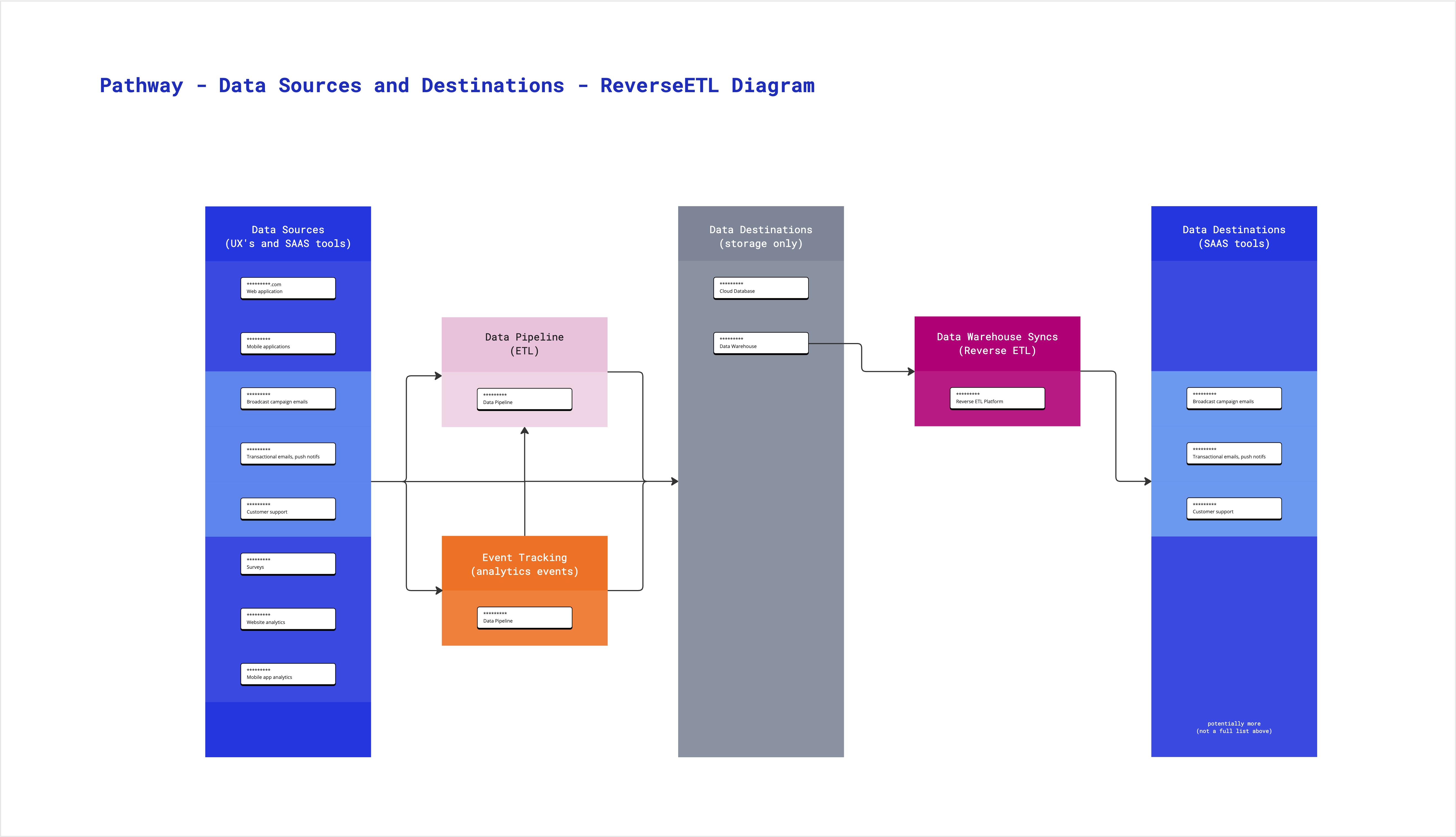

To power the personalized savings pathway and for organizational reporting, a reverse ETL approach was architected. This enabled the data orchestration layers to send data to and from a modern warehouse while keeping SAAS platforms in sync within the system.